About Medicare Supplement Plans

Medicare Supplement plans, (sometimes called Medigap plans), are insurance policies that include standardized sets of benefits offered by private health insurance companies that pay the portion of healthcare expenses that is not paid by Original Medicare. If you have Original Medicare, and you enroll in a Medicare Supplement plan, Medicare will pay it’s share of approved amount for health care costs that it covers and the Medicare Supplement plan will then cover its share of the costs.

Medicare Supplement plans, (sometimes called Medigap plans), are insurance policies that include standardized sets of benefits offered by private health insurance companies that pay the portion of healthcare expenses that is not paid by Original Medicare. If you have Original Medicare, and you enroll in a Medicare Supplement plan, Medicare will pay it’s share of approved amount for health care costs that it covers and the Medicare Supplement plan will then cover its share of the costs.

Ten Standardized Plans

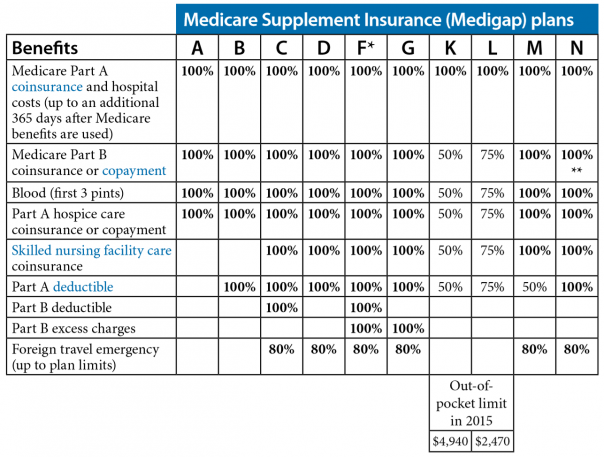

Private insurance companies that offer Medicare Supplement plans, offer a standardized package of benefits and cannot create plans that vary from these standardized plans. In most states (excluding MN, MA and WI) these Ten standardized plans are identified by letters A, B, C, D, F, G, K, L, M, and N. The the excluded states listed above, plans are standardized in a slightly different way.

The standardization of plans makes it easy to compare similar plans offered by different insurance companies.

For example ‘Plan A’ offered by Mutual of Omaha will offer identical benefits to ‘Plan A’ offered by Cigna, and in both cases, members can use any doctor that accepts Medicare payments. The only difference between the two policies would be the monthly premium and the insurance company providing the underlying benefits.

Medicare Supplement (Medigap) Plan Matrix

The chart below shows the benefits that each of the ten standardized Medicare Supplement plans provides.

* Plan F also offers a high-deductible option in some states. Plan F high-deductible requires you to pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,180 during the calendar year before your Medicare Supplement policy pays anything.

** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission.

Additional Info. About Medicare Supplement Plans

- You must be enrolled in both Medicare Part A & Part B to be eligible to purchase a plan.

- Medicare Supplement plans only cover a single person. Your spouse would be required to purchase his or her own policy

- The private insurance company that you purchase the Medicare Supplement plan from will bill you for that plan. In addition you will required to pay a monthly premium to for Medicare Part B directly to Medicare.

- The best time to buy a Medicare Supplement plan is during your open enrollment period — The 6 mo. period that begins on the first day of the month for which you are age 65 or older and enrolled in Medicare Part B

To speak to a licensed health care professional with questions about Medicare Supplement Insurance

call us Toll Free 877-941-0585

Additional Information you may be interested in: Medicare Advantage Plans, Medicare Part D