Medicare Supplement Plan C

Medicare Supplement Plan C — Sometimes referred to Medigap Plan C — is one of the ten standardized plans (A through N) offered by private insurance companies to help cover the costs not covered by Original Medicare. Plan C offers more coverage than any of the 10 Medicare Supplement plans with the exception of Plan F.

Medicare Supplement Plan C — Sometimes referred to Medigap Plan C — is one of the ten standardized plans (A through N) offered by private insurance companies to help cover the costs not covered by Original Medicare. Plan C offers more coverage than any of the 10 Medicare Supplement plans with the exception of Plan F.

All private insurance companies that offer the standardized Medicare Supplement plans are required to offer Medicare Supplement Plan C, in addition to Plan A & Plan F)

What Does Medicare Supplement Plan C Cover?

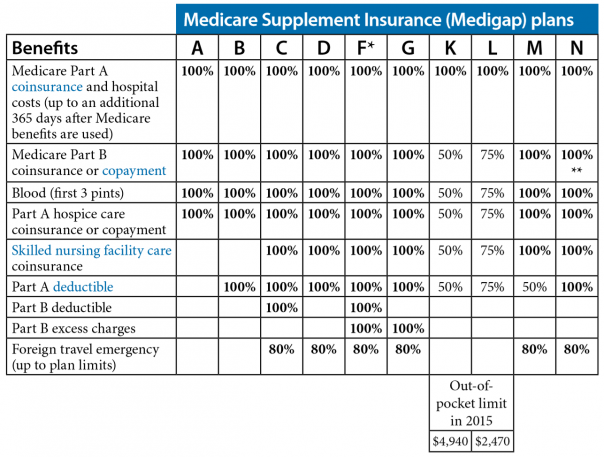

A chart of the benefits offered by each of the ten standardized Medicare Supplement plans can be found below. In summary:

Medicare Supplement Plan C covers:

- Medicare Part A hospital coinsurance and hospital costs after Original Medicare benefits are exhausted (up to 365 days)

- Medicare Part A hospice care coinsurance or copayments

- Medicare Part B copayments and/or coinsurance

- First three pints of blood needed for a medical procedure

- Skilled Nursing Facility care coinsurance

- Medicare Part A deductible

- Medicare Part B deductible

- Foreign travel emergency coverage (80% of approved costs up to plan limits)

(The bolded items above are not covered by Medicare Supplement Plan A)

The one item in the chart above that Medicare Plan C does not cover is Part B excess charges. Part B Excess charges refer to the amount that doctors may charge you beyond Medicare approved charges for a service. In these cases the excess charges would be billed directly to the patient. Doctors are permitted to charge up to 15% above Medicare approved charges in some cases. Only two Medicare Supplement plans cover Part B excess charges — Plan F, and Plan G.

To speak to a licensed health care professional with questions about Medicare Supplement Plans

call us Toll Free 877-941-0585