Medicare Supplement Plan A

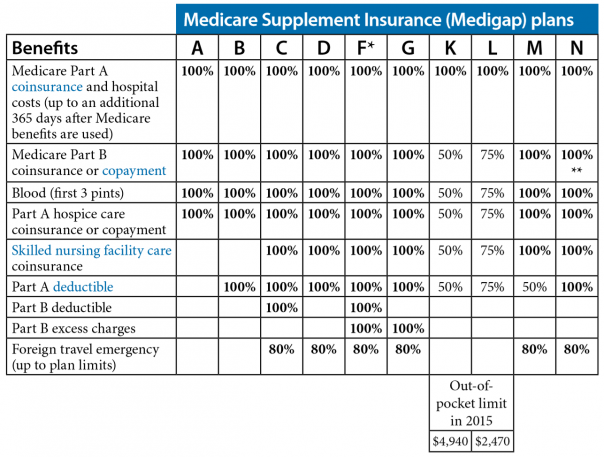

Medicare Supplement Plan A — not to be confused with Medicare Part A — is one of Ten standardized plans offered by private insurance companies to fill in the gaps not paid by Original Medicare. The plans may also be referred to as Medigap Plan A.

Medicare Supplement Plan A — not to be confused with Medicare Part A — is one of Ten standardized plans offered by private insurance companies to fill in the gaps not paid by Original Medicare. The plans may also be referred to as Medigap Plan A.

Medicare Supplement Plan A, is the least expensive and provides the least amount of supplemental coverage when compared to the nine other standardized plans. It can be a good solution for those who want to keep their monthly premiums down, however enrolling in a Medicare Supplement Plan A from a private insurer may result in greater out of pocket costs when compared to other standardized Medicare Supplement Plans particularly if the member is admitted to the hospital.

What Does Medicare Supplement Plan A Cover?

Medicare Supplement Plan A Covers

- Medicare Part A coinsurance payments after Original Medicare benefits are exhausted (up to an additional 365 days)

- Medicare Part B copayment or coinsurance expenses (including preventative care coinsurance expenses)

- The first three pints of needed for a medical procedure

- Part A hospice care coinsurance expense or copayment

All private insurers who offer Medicare Supplement plans are required by law to offer Plan A, Plan C, and Plan F.

To speak to a licensed health care professional with questions about Medicare Supplement Plans

call us Toll Free 877-941-0585