Medicare Supplement Plan F

Medicare Supplement Plan F — sometimes also referred to as Medigap Plan F — provides the most comprehensive benefits of the ten standardized Medicare Supplement Plans. Because plan F provides the most benefits it is generally also the most expensive of the Medigap options as you might expect.

Medicare Supplement Plan F — sometimes also referred to as Medigap Plan F — provides the most comprehensive benefits of the ten standardized Medicare Supplement Plans. Because plan F provides the most benefits it is generally also the most expensive of the Medigap options as you might expect.

Plan F in general is a good value for individuals that require regular medical attention that would otherwise require significant out of pocket expenses.

What does Medicare Supplement Plan F Cover?

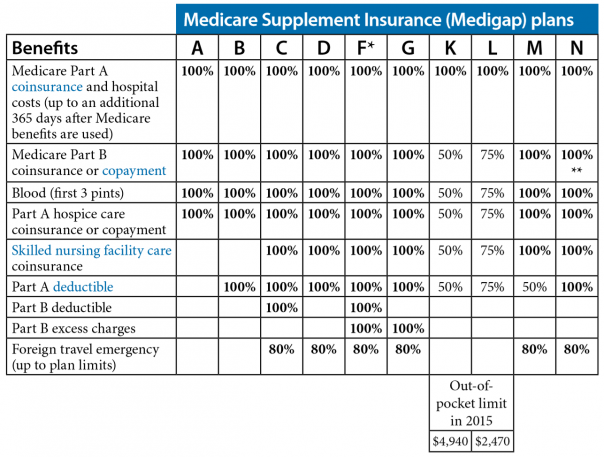

Like all Medicare Supplement Plans, Plan F covers

- Medicare Part A hospital and co-insurance costs up to an additional 365 days after Medicare benefits are exhausted

Additional benefits include

- Medicare Part B coinsurance or copayment (covered in full by all Medigap plans except plans K&L)

- First three pints of blood used in an approved medical procedure (covered in full by all Medigap plans except plans K&L)

- Part A hospice care co-payment or co-insurance (covered in full by all Medigap plans except plans K&L)

- Medicare Part A Deductible

- Medicare Part B Deductible

- Medicare Part B Excess Charges (covered only by Plan F & Plan G)

- Skilled Nursing Facility coinsurance

- Foreign travel emergency (at 80%)

The chart below provides a comparison of the benefits provided by each of the ten standardized Medicare Supplement Plans (Medigap).

Medicare Supplement Plan F (High Deductible Option)

In addition to the traditional Plan F, There is high deductible option that requires Medicare beneficiaries to pay out-of-pocket expenses for the first $2,180 (in 2016) before benefits kick in.

This high deductible option is a cheaper alternative to the standard Plan F, since the beneficiary must pay the first $2,180 of costs out-of-pocket.

To speak to a licensed health care professional with questions about Medicare Supplement Plan F

call Toll Free 877-941-0585